Comparison of the Stablecoin Standard Framework and the GENIUS Act

By Beth Haddock, Global Head of Policy and Advisory Board Member

The U.S. is at a pivotal moment for crypto regulation, with stablecoin legislation emerging as a key priority. The recently introduced GENIUS Act aims to establish a regulatory framework for stablecoins in the U.S. While we anticipate ongoing adjustments, the House Financial Services Committee has already released a draft of the STABLE Act of 2025. To assess alignment with industry best practices, we’re sharing an initial comparison against the Stablecoin Standard framework for fiat-backed stablecoins.

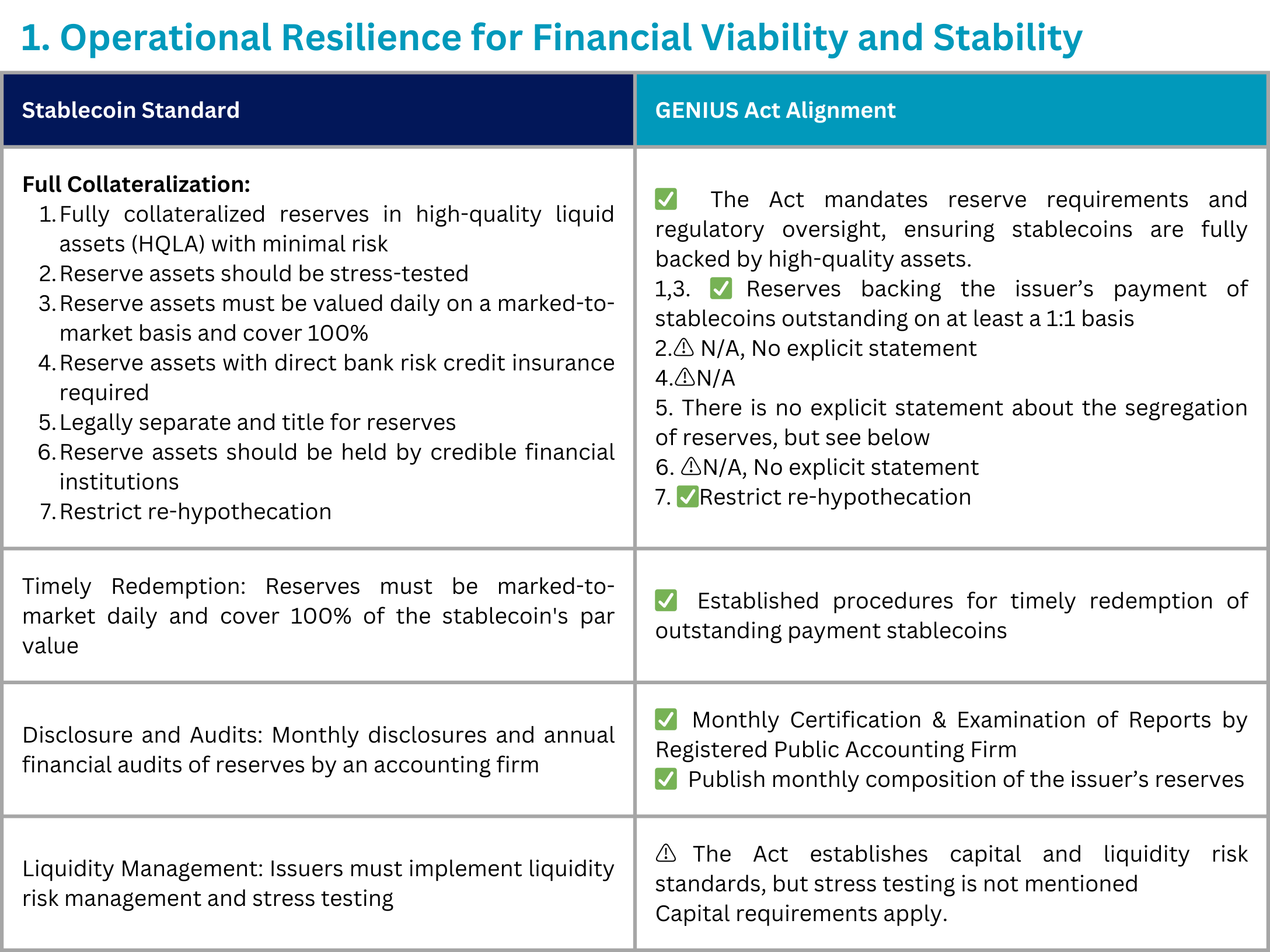

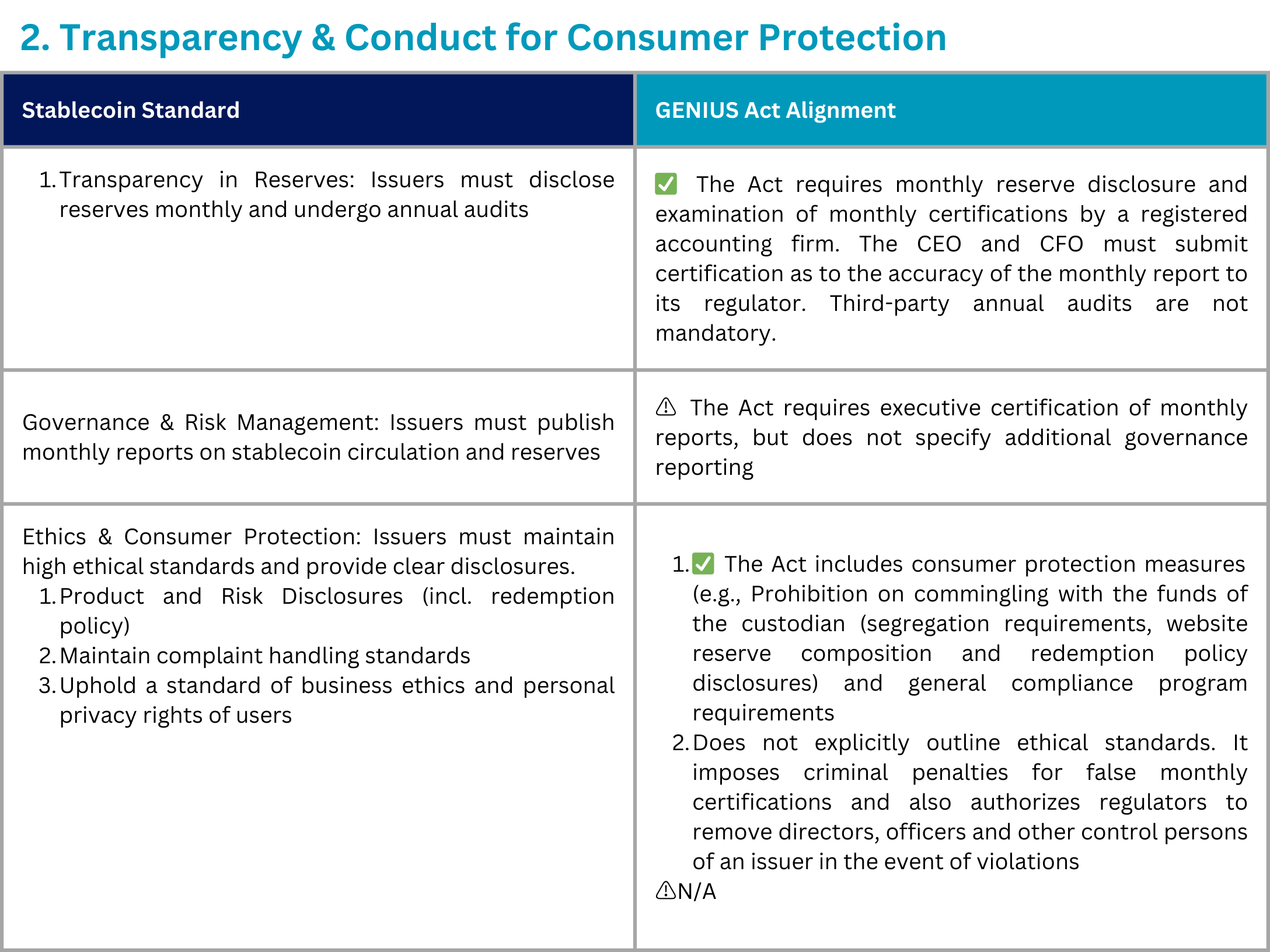

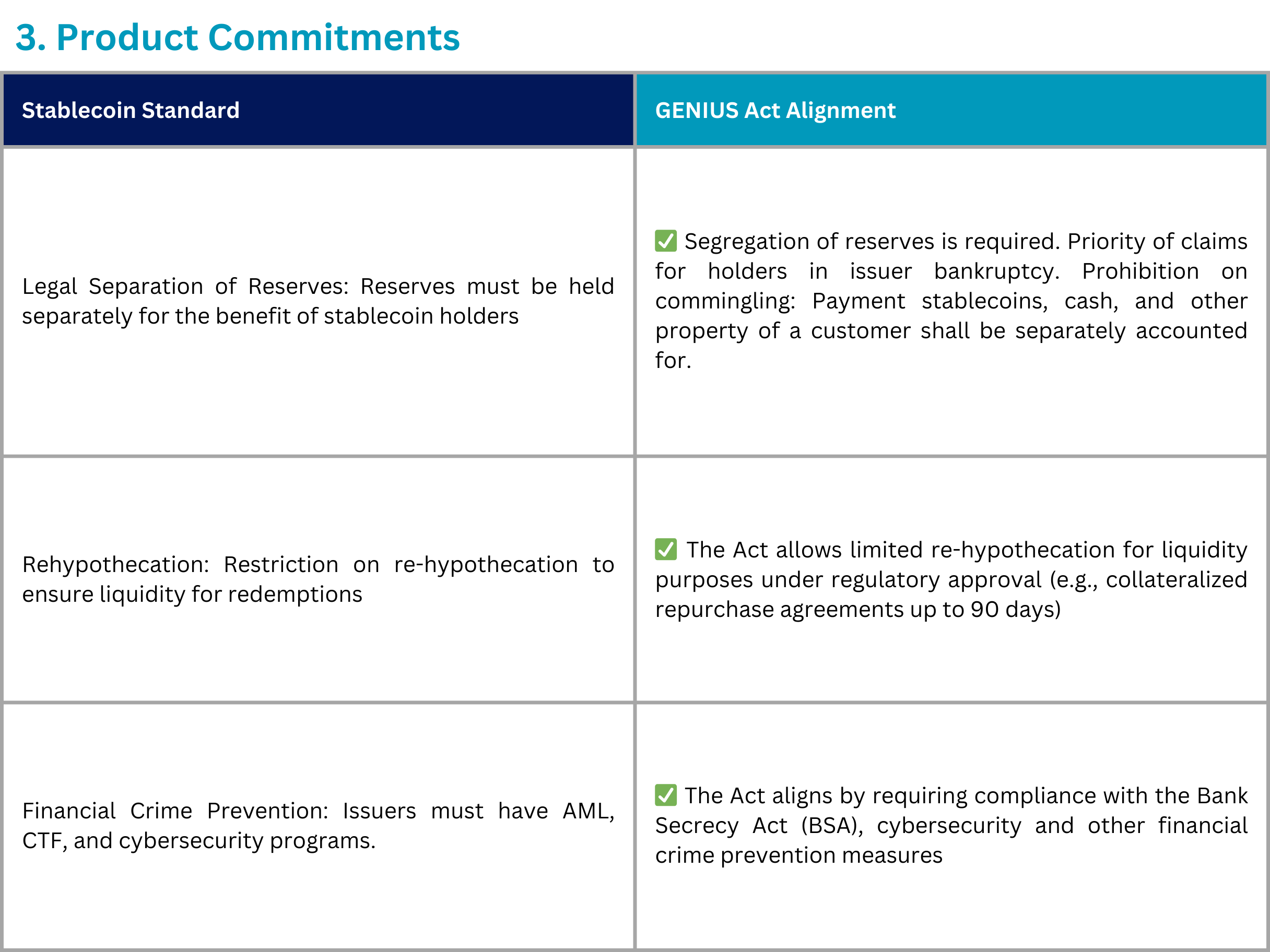

In Q3 2024, Stablecoin Standard (SCS) introduced its framework after reviewing global regulatory requirements, including NYDFS and MiCA, across three key pillars:

🔹 Operational Resilience

🔹 Transparency & Conduct

🔹 Product Commitments

This comparison underscores the critical role of industry participation in shaping both legislation and implementing regulations. With input from over 30 issuers and service providers, we bring valuable perspectives to the discussion.

📊 See the chart below for a breakdown of key similarities and differences.

Key Takeaways

✅ The GENIUS Act aligns closely with the Stablecoin Standard on collateralization and financial crime prevention. There are some differences in the approach for stress testing, governance reporting, third-party audits, and explicit legal separation of reserves. These differences should be addressed in implementing regulations.

📢 Industry perspective is crucial in shaping the final legislation and implementing regulations.